GCC Advanced Wound Care Market Size, Share, Trends, and Forecast by Product, Application, End User, and Country, 2026-2034

GCC Advanced Wound Care Market Size and Share:

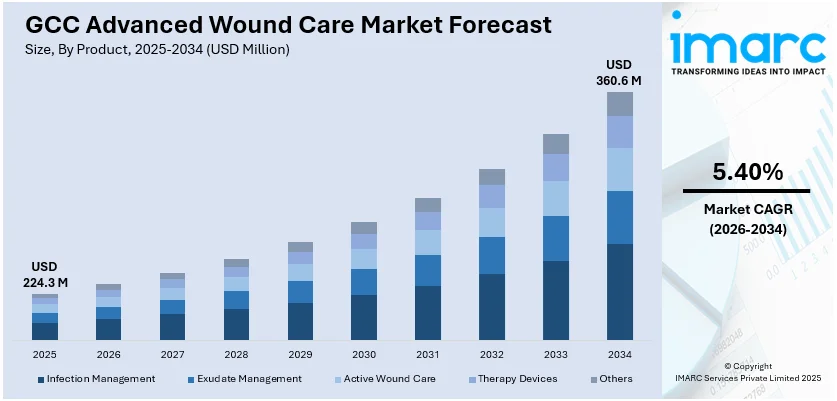

The GCC advanced wound care market size was valued at USD 224.3 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 360.6 Million by 2034, exhibiting a CAGR of 5.40% from 2026-2034. The market is driven by the rising healthcare expenditure that allows the adoption of innovative wound management solutions, along with the increasing need for advanced wound care services that generate significant revenue for healthcare providers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 224.3 Million |

| Market Forecast in 2034 | USD 360.6 Million |

| Market Growth Rate (2026-2034) | 5.40% |

Advancements in wound care technology are improving the effectiveness and efficiency of wound management in the GCC region. Innovations, such as advanced wound dressings like hydrocolloids, alginates, and hydrogel offer better moisture control, infection prevention, and faster healing. In addition, technologies like negative pressure wound therapy (NPWT) have enabled better treatment of chronic and complex wounds by promoting blood flow and tissue regeneration. Moreover, bioengineered skin substitutes and growth factor therapies enhance the healing process for severe wounds, including diabetic foot ulcers and burns. These improvements have reduced recovery times, minimized complications, and upgraded patient outcomes, driving the demand for advanced wound care products.

To get more information on this market Request Sample

Regulatory support and standards are impelling the GCC advanced wound care market growth. They ensure the quality, effectiveness, and safety of wound care products. Stringent healthcare regulations and product approval processes in the region guarantee safe and reliable advanced wound care solutions and make them available to healthcare providers and patients. Regulatory bodies, such as the Saudi Food and Drug Authority (SFDA) and the UAE's Ministry of Health have established clear guidelines for wound care products, fostering trust in their use. Compliance with these standards ensures that advanced wound care products, such as bioengineered skin substitutes and advanced dressings, meet the required therapeutic criteria, resulting in improved patient outcomes. This regulatory environment promotes the adoption of high-quality wound care solutions.

GCC Advanced Wound Care Market Trends:

Increasing healthcare expenditure

The rising healthcare expenditure in GCC countries is fueling the market growth. Government agencies across the region are investing heavily in healthcare infrastructure for enhancing patient care as well as serve the growing healthcare requirements of their populations. As per the data published on the official website of the International Trade Administration, Under Vision 2030, the Saudi Arabian Government allocated over $65 billion to enhance the nation's healthcare infrastructure, reorganize and privatize health services and insurance services, as well as broaden the delivery of e-health services. Besides this, in the GCC region, resources are being spent on the development of specialized medical centers, advanced diagnostic technologies, and the introduction of cutting-edge treatment options. As a result, there is greater availability of advanced wound care products and therapies like growth factors, therapy devices and bioactive dressings. Moreover, higher healthcare spending allows innovations in wound management solutions, improvements in patient outcomes, and reduction in long-term care costs.

Rising prevalence of chronic diseases

The rising prevalence of chronic diseases, particularly obesity, diabetes, and cardiovascular conditions, is bolstering the market growth. According to the information provided on the official website of the International Diabetes Federation, the count of diabetes patients in the UAE is projected to reach 1,325,800 by 2045. Diabetes significantly increases the chances of developing chronic wounds, such as diabetic foot ulcers. Since this group of conditions can be easily introduced in the community through lifestyle elements, there is increased demand for advanced wound care products like antimicrobial dressings, bioactive solutions, as well as the negative pressure devices for wound therapy. Advanced care is necessary to be employed with such injuries. It helps by accelerating healing and offers relief. It reduces and prevents infection at the wound, thus avoiding additional complications like amputation. Further, in the GCC region, several health initiatives to reduce the cases of chronic disease are being introduced that enhance the use of advanced solutions in wound care.

Growing aging population

The rising population in the GCC region, particularly the aging demographic, is positively influencing the market. As the elderly population grows, chronic diseases, such as diabetes occur more frequently, hence resulting in a higher incidence of chronic wounds, including diabetic foot ulcers and pressure sores. Adults are more vulnerable to wounds since the factors of old age trigger slower healing processes. This growing demand for specialized wound care solutions has increased the adoption of advanced wound care products like bioengineered skin substitutes. Furthermore, the rising population means a greater overall need for healthcare services, including wound management. This demographic trend fuels the market growth by creating an ongoing need for effective, efficient, and advanced wound care treatments across the GCC region. According to the research paper published by the World Bank Organization, The number of individuals over 65 years old per 100 individuals is anticipated to nearly double in Saudi Arabia from 2020 to 2030. To deal with this change, Saudi Arabia has to increase healthcare expenditures in the upcoming years to address the rising challenge of non-communicable diseases in its aging demographic.

GCC Advanced Wound Care Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC advanced wound care market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product, application, and end user.

Analysis by Product:

- Infection Management

- Silver Wound Dressings

- Non-silver Dressings

- Collagen Dressings

- Exudate Management

- Hydrocolloids Dressings

- Foam Dressings

- Alginate Dressings

- Hydrogel Dressings

- Active Wound Care

- Skin Substitutes

- Growth Factors

- Therapy Devices

- Negative Pressure Wound Therapy (NPWT)

- Oxygen and Hyperbaric Oxygen Equipment

- Electromagnetic Therapy Devices

- Others

Infection management (silver wound dressings, non-silver dressings, and collagen dressings) is employed to inhibit infection risks in chronic and acute wounds, such as diabetic ulcers and surgical incisions. As more people suffer from diabetes and obesity in the region, they need infection management solutions to prevent complications in wound healing.

Exudate management (hydrocolloids dressings, foam dressings, alginate dressings, and hydrogel dressings) manages wound moisture and promotes faster healing. It is essential for chronic wounds like pressure ulcers and venous leg ulcers. Healthcare providers employ exudate management products to reduce infection risks after surgical procedures and improve patient outcomes.

Active wound care (skin substitutes and growth factors) includes advanced products designed to accelerate the healing process. This segment caters to the rising cases of chronic wounds, such as diabetic foot ulcers and burns. Active wound care solutions are being employed to improve treatment efficacy and reduce hospital stays. Increased patient awareness and demand for effective wound care further drive the adoption of these products.

Therapy devices (negative pressure wound therapy (NPWT), oxygen and hyperbaric oxygen equipment, and electromagnetic therapy devices) are widely used for chronic and complex wound management, offering improved healing outcomes. The segment benefits from the rising incidence of non-healing wounds and the high demand for home-based care solutions. Advancements in device technology further allow enhancements in the uses of therapy devices.

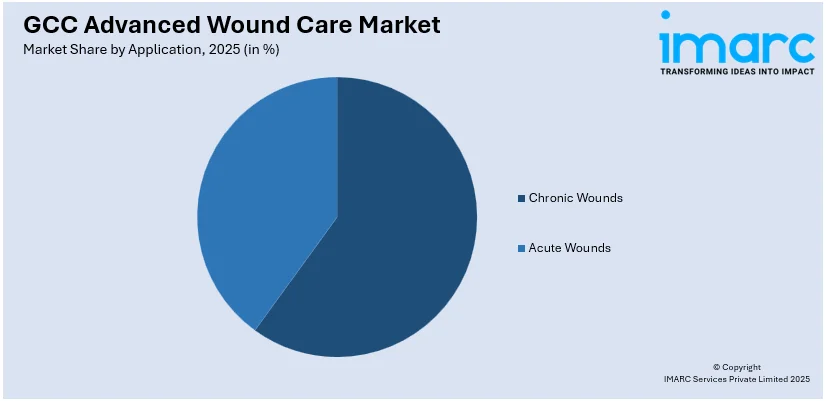

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Chronic Wounds

- Pressure Ulcers

- Diabetic Foot Ulcers

- Venous Leg Ulcers

- Arterial Ulcers

- Acute Wounds

- Burns and Trauma

- Surgical Wounds

Chronic wounds (pressure ulcers, diabetic foot ulcers, venous leg ulcers, and arterial ulcers) comprise a significant portion of the GCC advanced wound care market share. The region's high prevalence of diabetes, obesity, and aging populations drives the demand for long-term wound management solutions. Advanced products like antimicrobial dressings, skin substitutes, and NPWT are widely adopted to improve healing outcomes of chronic wounds.

Acute wounds (burns and trauma and surgical wounds) require advanced care solutions for fast and effective healing. The rising number of surgical procedures and accidents, coupled with advancements in healthcare infrastructure, creates the need for acute wound care products. Solutions like hydrocolloid dressings, foam dressings, and growth factors are used to ensure faster recovery. Hospitals and emergency care centers are the primary adopters, supported by government investments in healthcare modernization.

Analysis by End User:

- Hospitals

- Community Health Service Centers

Hospitals are primary care providers for chronic and acute wound management in GCC countries. Equipped with advanced technologies like NPWT and bioactive dressings, hospitals cater to patients with severe wounds, including diabetic ulcers and surgical wounds. Moreover, government agencies wager on healthcare infrastructure and specialized wound care units to facilitate the availability of wound care products and improve patients’ quality of life.

Community health service centers cater to the high demand for outpatient and home-based care. These centers provide cost-effective solutions for managing chronic wounds like pressure ulcers and diabetic foot ulcers. With a focus on accessibility and convenience, community centers adopt products, such as antimicrobial dressings and foam-based solutions. Furthermore, community centers play a key role in reducing hospital burden and improving overall healthcare efficiency.

Country Analysis:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Saudi Arabia possesses a robust healthcare system, facing a significant occurrence of chronic conditions, including diabetes and obesity. The nation's health programs have increased funding for medical technology and facilities. Additionally, individuals and healthcare providers are knowledgeable about advanced wound care products. This region experiences elevated rates of telemedicine and home healthcare service usage, especially among elderly and immobile individuals.

The UAE is recognized for its strong healthcare system as well as considerable healthcare spending. The nation's emphasis on medical tourism and its state-of-the-art hospitals outfitted with the latest technology establish it as a center for wound care therapies. In addition, the widespread occurrence of lifestyle-related illnesses generates the need for sophisticated wound care options. Furthermore, partnerships between big healthcare providers and local service providers enhance the accessibility of care solutions.

Qatar's healthcare framework, featuring advanced hospitals and specialized clinics, fosters the use of cutting-edge wound care technologies. The nation’s healthcare approaches prioritize the management of chronic diseases. In addition to this, regional government agencies aim to enhance patient outcomes by utilizing early intervention and advanced treatment alternatives, such as contemporary wound care products.

In Bahrain, there is a high number of patients suffering from chronic diseases, which creates the need for advanced wound care solutions. The government’s initiatives to enhance healthcare infrastructure emphasize improved patient care. Moreover, private healthcare providers in this region are expanding access to advanced wound care technologies. Ongoing awareness campaigns and training programs for healthcare professionals also increase the adoption of best practices in wound care.

Kuwait's advanced wound care industry is expanding due to rising healthcare awareness and governmental efforts to modernize the healthcare system. Kuwait promotes the use of advanced healthcare technologies, such as hydrocolloid dressings, to enhance patient outcomes. In addition to this, there is a significant quantity of global healthcare providers and distributors that improve the availability of cutting-edge wound care products. Partnership among the private and public sectors, in confluence with investments in medical training, foster progress in wound management.

In Oman, the government seeks to improve healthcare services and facilities. Individuals with chronic illnesses and peripheral vascular conditions require wound care supplies. Furthermore, the nation highlights the implementation of contemporary healthcare technologies, such as sophisticated wound care solutions. Additionally, the growth of private medical facilities and the launch of home care services enhance the availability of advanced wound care products.

Competitive Landscape:

Key players in the regional market are investing in research and development (R&D) activities to introduce advanced products like bioactive dressings, skin substitutes, and therapy devices that cater to diverse wound care needs. Additionally, key players conduct training programs and awareness campaigns to educate healthcare professionals on advanced wound care solutions. They also partner with government agencies and healthcare institutions to align with initiatives and modernize healthcare infrastructure. By leveraging technological advancements and tailoring solutions to regional healthcare challenges, key players encourage the adoption of innovative wound care products. They team up with regional distributors and healthcare providers to improve accessibility of the product and enhance market penetration. For instance, in August 2024, Kane Biotech, a technology company, entered into a distribution agreement with Qatar Datamation Systems (QDS) for revyve antimicrobial wound gel for a duration of three years. The firm proceeded with the commercialization of revyve by securing its second distribution deal in the Middle East.

The report provides a comprehensive analysis of the competitive landscape in the GCC advanced wound care market with detailed profiles of all major companies.

Latest News and Developments:

- May 2024: Mölnlycke Health Care, a wound care solutions provider, increased its investment in the Tamer Mölnlycke Care joint venture by raising its ownership to 60% to broaden operations in the Middle East. This will enable the growth of various Mölnlycke wound care items, such as gowns and drapes, produced and supplied within the country.

- October 2024: The Royal Medical Services, a prominent healthcare communications agency, teamed up with RCSI Medical University of Bahrain to identify effective advancements in the treatment of diabetic skin ulcers. They worked to develop and employ an innovative biomaterial that could improve wound healing in diabetic skin ulcers by promoting blood vessel development and minimizing tissue scarring.

- November 2024: DEBx Medical, a medical technology firm, declared the successful conclusion of its second funding round led by TVM Capital Healthcare, a capital investment company. It reaffirmed its commitment to the TVM Healthcare Afiyah Fund strategy aimed at delivering innovative solutions in chronic wound management to the MENA region, especially in the Kingdom of Saudi Arabia.

- November 2024: Oneness Biotech Co.’s Bonvadis topical cream was granted medical device marketing authorization for all wound-related indications, encompassing acute wounds, chronic wounds, and scars, classified under the wound dressing category in Saudi Arabia. It received approval to be sold in the country.

- December 2024: The Saudi Ministry of Industry and Mineral Resources, along with the Kingdom's Ministries of Investment and Health, announced an alliance with Vertex, a pharmaceutical firm. They envision supporting local innovations and creating biomanufacturing skills in cell and gene therapy in Saudi Arabia.

GCC Advanced Wound Care Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered |

|

| End Users Covered | Hospitals, Community Health Service Centers |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC advanced wound care market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC advanced wound care market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC advanced wound care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The GCC advanced wound care market was valued at USD 224.3 Million in 2025.

IMARC estimates the GCC advanced wound care market to exhibit a CAGR of 5.40% during 2026-2034.

The growing number of surgical procedures in the region, including cosmetic and reconstructive surgeries, is leading to an increased incidence of surgical wounds that require advanced care solutions. Besides this, the rising awareness among healthcare professionals and patients about the benefits of advanced wound care treatments is impelling the market growth. The expansion of healthcare facilities, along with better access to advanced healthcare treatments in both urban and rural areas, is supporting the growth of the market.

On a regional level, the market has been classified into Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, and Oman.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)